Liquidity Pressure — visual analysis of order book strength

The Liquidity Pressure widget provides traders with a visual representation of buyer and seller strength based on weighted liquidity analysis of the order book (DOM).

This tool helps assess the real balance of power between buyers and sellers in real time.

Principle of Operation

Calculation of Buyer and Seller Strength

The widget analyzes order book data and calculates weighted liquidity for both sides:

Bid Liquidity (Buyer Strength):

All buy orders in the order book are summed up.

Each order is multiplied by a weight depending on its distance from the best bid/ask.

Orders closer to the market have a higher weight.

The final value represents the total strength of buyers.

Ask Liquidity (Seller Strength):

Calculated in the same way for sell orders.

Represents the total strength of sellers.

Calculation Formula:

Weighted Liquidity = Σ(Order Volume × e^(−Level Number / Weight Decay))

Exponential Decay Principle (Weight Decay)

The Weight Decay parameter determines how quickly the influence of orders decreases with distance from the market.

Low values (1–3): near-market orders have maximum weight, distant orders are almost ignored.

Useful for short-term pressure analysis and immediate execution readiness.Medium values (4–10): balanced consideration of near and distant levels.

Provides an overall picture of liquidity distribution.High values (11–20): all levels are considered more evenly.

Shows general market depth, including large distant orders.

Example (Weight Decay = 3):

Level 1: ≈100% weight

Level 2: ≈51%

Level 3: ≈37%

Level 5: ≈19%

Level 10: ≈4%

Training Period

When the widget is launched or when the instrument changes, a training period begins.

What happens:

The widget collects liquidity data over the selected period (default: 1 minute).

Tracks the maximum Bid and Ask liquidity values.

These maxima are used to normalize current values as percentages (0–100%).

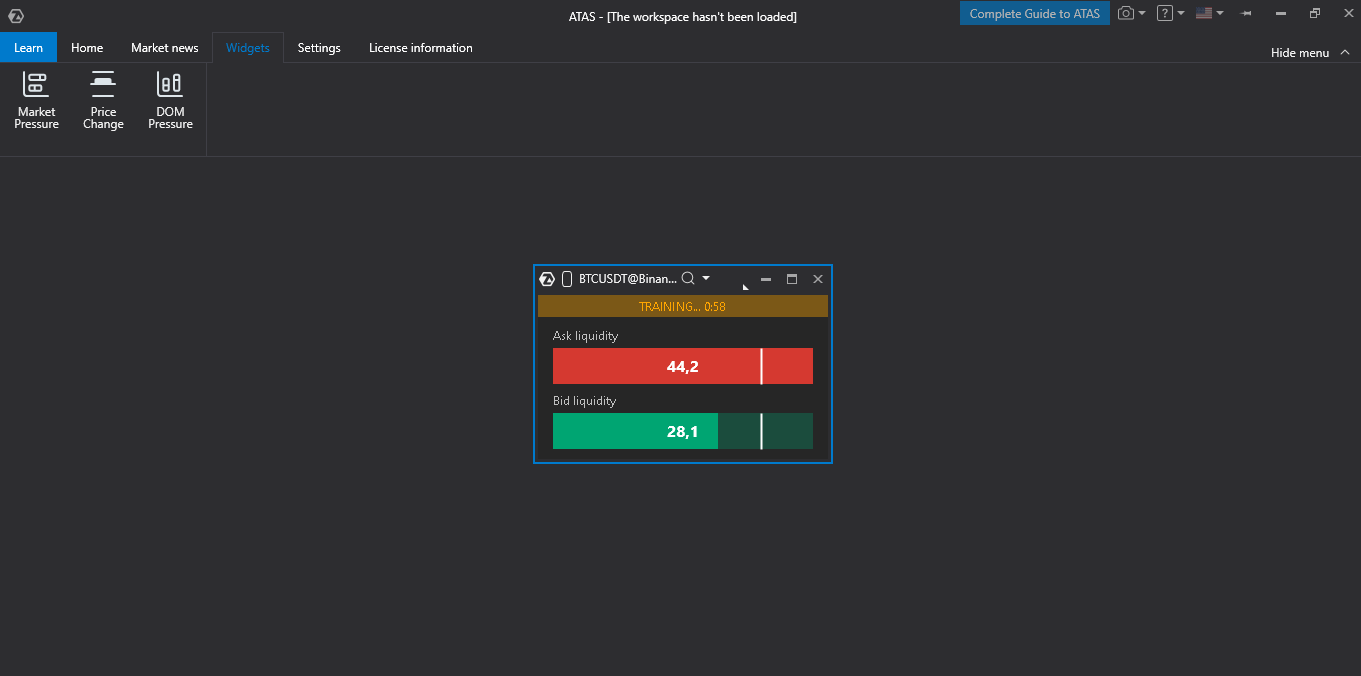

Visual Indication:

An orange bar labeled “TRAINING... M:SS” appears at the top of the widget.

Displays the countdown until training is complete.

Data is already visible, but sound alerts are disabled.

Purpose of the training phase:

Adapts to current market conditions (each instrument has different typical liquidity).

Automatically calibrates bar scaling for correct display.

Determines “normal” liquidity levels for each instrument.

After training, you see relative values — how current liquidity differs from typical conditions.

Sliding Window:

After training, the widget continues tracking maxima in a sliding window.

If the market changes (e.g., volatility or liquidity increases), maxima update automatically.

Ensures normalization remains accurate throughout the trading session.

Main Functionality

Visualization

Three display modes are available:

Horizontal — horizontal bars for Bid and Ask liquidity.

Vertical — vertical bars displayed side by side.

Center — bars grow outward from the center in opposite directions.

Each mode displays:

Colored liquidity bars (green for Bid, red for Ask).

Numeric values of weighted liquidity.

Threshold line for visual evaluation of excessive levels.

“TRAINING...” indicator with countdown during the training phase.

Bars are normalized on a unified scale — allowing direct comparison of buyer and seller strength.

Calculation Settings

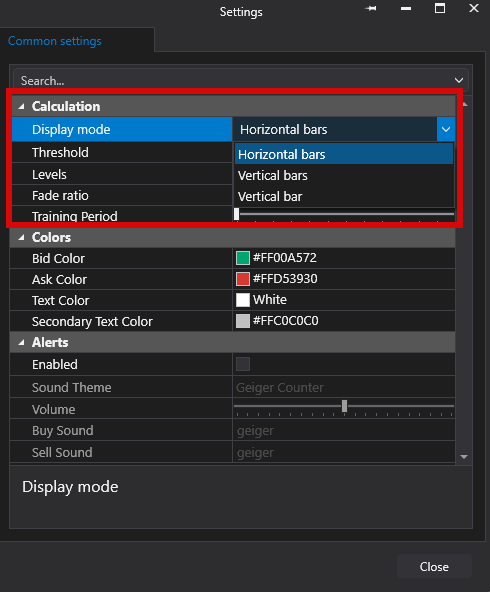

Display Mode — visualization type (Horizontal / Vertical / Center).

Threshold — threshold value in % (default: 80%). Sound alerts trigger when exceeded.

Levels — number of order book levels analyzed (5–50, default: 10).

Weight Decay — exponential weight decay factor (1–20, default: 3). Lower values give more weight to near-market levels.

Training Period — duration of training in minutes (1–60, default: 5). Used to collect baseline liquidity maxima.

Sound Alerts

Enable or disable sound alerts.

Choose sound theme (Geiger Counter / Custom / Custom Pitch).

Adjust sound volume.

Separate sound files for Bid and Ask pressure alerts.

Alerts are triggered when liquidity exceeds the threshold level.

No sound is played during the training period.

Color Scheme

Customizable colors for:

Bid liquidity (default: green)

Ask liquidity (default: red)

Primary text

Secondary text (labels)

Trading Applications

The Liquidity Pressure widget helps traders:

Identify demand/supply imbalances in the order book.

Detect zones of concentrated liquidity.

Recognize aggressive buyers or sellers through rising pressure.

Make entry or exit decisions based on order book pressure.

Receive sound alerts when significant pressure changes occur.

Assess overall market depth — how far large orders are positioned from the best bid/ask.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article