Smart DOM module overview

Module purpose

The Smart DOM module is designed for executing trades. It includes advanced functionality such as semi-automated protective strategies, one-click order submission, and the ability to customize the appearance and behavior using the Design mode. This module suits any trading style.

How to open the module

To open this module, click the Smart DOM icon on the Home tab.

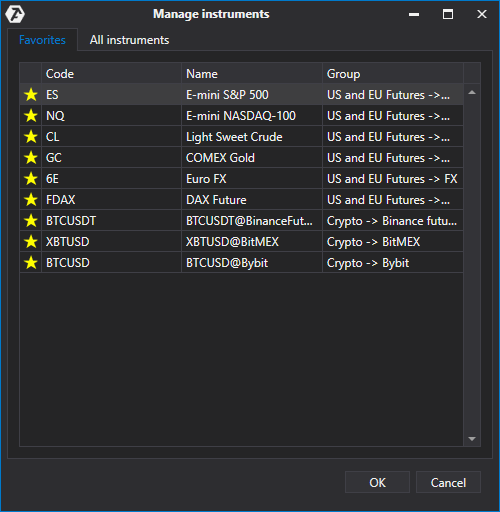

This will open the Instruments manager window:

In this window, select the instrument from the Instruments or Favorites tab.

Adding instruments to the Favorites tab is described in detail here: Instruments manager.

Once the instrument is selected, the DOM window will open:

Please note: not all available elements are displayed when the module is opened for the first time. Use the context menu Show all elements or activate Design mode to view them all.

Module description

- Instrument ticker – click to change the instrument.

- Scale function.

- Clone window.

- Layout selection.

- Window grouping.

- Smart DOM settings.

- Topmost – keep DOM always on top.

- Trading account.

- Order duration – DAY (until end of session), GTC (until manually canceled).

- Fast volume input.

- Volume – manual volume input.

- Exit Strategy – see Exit Strategy article.

- DOM columns.

- Reverse – reverse position at market price.

- Flatten – close all open positions and orders.

- Cancel all – cancel all orders.

- OCO Group – if one order is filled or canceled, others in the group are canceled automatically.

- Lock trading – prevents accidental clicks.

- Position status – shows FLAT or position size/direction.

- Center – center spread in one or all DOMs.

You can also center the spread by double-clicking the price column in the DOM.

Context menu settings

Right-click any area of the DOM (except trading columns) to open the context menu.

- Lock trading – disables trading interactions.

- Design mode – customize button sizes, colors, texts, and layout. Read more here.

- Show all elements – reveal all hidden UI elements.

- Settings – open module settings window (also via button 6).

- Clone window.

Hidden DOM elements

- BUY MARKET / SELL MARKET – market order.

- BUY BID / SELL BID – limit on BestBid.

- BUY ASK / SELL ASK – limit on BestAsk.

- Type – select pending order type.

- Limit/Stop – set price.

- Send Order – send pending order.

Related articles

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article